In this article, we take a closer look at the world of concerts, festivals and live sports. Wherever thousands gather to enjoy music or cheer for their team, someone has to make sure everything runs smoothly behind the scenes. That is where CTS Eventim comes in. We will explore whether the company is a quality compounder worth considering for our portfolio and at what price it might become attractive. Let’s dive in.

The story of CTS Eventim is closely tied to the vision and leadership of Klaus-Peter Schulenberg. When he took over the company in 1996, it was little more than a niche software provider with just 83 employees. But the idea behind it was both simple and ambitious: to build a centralized digital platform for ticket sales, at a time when most tickets were still sold over the phone or at physical counters. What might have seemed like a bold bet back then has since turned into one of the most compelling long-term growth stories in the European entertainment industry.

CTS Eventim went public in 2000, and what followed was a period of remarkable expansion. Over the past two decades, the company has delivered a total shareholder return of more than 3,100 percent, or about 19 percent annually. The headcount has grown more than fiftyfold, reaching over 4,400 employees by 2024. In recent years CTS systematically broadened its reach through acquisitions of ticketing platforms and event organizers in Italy, the Netherlands, Spain, Scandinavia and South America.

Today, the company is active in more than 20 countries and organizes thousands of events every year, from international football tournaments to some of Europe’s largest music festivals. What started as a regional software business has evolved into a continent spanning infrastructure for live entertainment, and the transformation is still ongoing.

From Tickets to Arenas: Understanding the Business Model

To understand CTS Eventim, it is essential to first understand the structure of its business. The company operates at the intersection of technology and live entertainment. Its core strength lies in combining a highly scalable ticketing infrastructure with a growing portfolio of live events and venue operations. While these two segments differ in terms of margins and stability, they are closely linked and designed to reinforce each other.

At the heart of the model is the ticketing platform. CTS Eventim sells tickets for concerts, sports events, theatre and other cultural activities in over 20 countries. The company does not simply act as a marketplace but provides the full infrastructure behind the scenes. Organizers who lack the necessary IT systems rely on CTS to manage the entire sales process. This includes physical presale offices, call centers and country-specific online shops. The system is optimized for performance and reliability, even under peak loads, and integrates customer data and targeted marketing to maximize sales. Revenue is generated primarily through per-ticket service fees, which vary depending on the event and price category.

The second pillar is the Live Entertainment segment. Here, CTS Eventim organizes and promotes events ranging from stadium tours to festivals and exhibitions. In many cases, the company also operates the venues, such as in Cologne, London or Copenhagen and ongoing projects include a new arena in Milan and another in Vienna, both scheduled to open in the coming years. While CTS is not the owner of these properties, it holds long-term operating contracts that allow it to earn a share of revenue from ticket sales, catering, merchandising and premium services. This asset-light approach limits capital intensity while securing a deeper share of the value chain.

This dual structure gives the company a high degree of vertical integration. When selling tickets for third-party events, CTS earns a fixed fee. But when promoting its own shows or operating the venue, the economics shift in its favor. Although ticketing accounts for only about 31 percent of total revenue, it delivers most of the group’s profit due to its superior margins. Live Entertainment generates around 69 percent of revenue but is more volatile and capital intensive. Both segments are therefore essential, with ticketing providing stability and cash flow, while live events offer content exclusivity.

Regionally, the business remains centered in Europe. In 2024, Germany contributed 46.4 percent of revenue, followed by Italy at 19.1 percent, Switzerland at 7 percent, the United States at 6 percent and Austria at 5.7 percent. In total, around 78 percent of revenue came from Europe, making it by far the most important region. While CTS is expanding into new markets, particularly in Latin America and North America, the core remains European.

Like the structure itself, the dynamics of the business are mixed. Ticketing is relatively stable and benefits from recurring demand, even in times of economic uncertainty. However, it is also shaped by rapid technological change, from mobile-first platforms to dynamic pricing, blockchain integration and increasing regulatory standards. Live Entertainment is more cyclical and exposed to short-term shocks, such as pandemics or economic downturns. At the same time, it creates opportunities for strategic positioning and brand visibility.

The long-term stability of CTS Eventim is not only a result of its business model, but also of its leadership. While many public companies see frequent changes at the top, CTS has been led by Klaus-Peter Schulenberg for nearly three decades. Today, his influence remains central to the company’s strategy, culture and decision-making. From the expansion into new markets to major partnerships and acquisitions, Schulenberg continues to shape the group’s direction with a clear long-term vision.

Through the KPS Foundation, he controls nearly 39 percent of voting rights, making him by far the largest individual shareholder. His daughter’s presence on the supervisory board reinforces the founder-led nature of the business, even though the majority of shares are in free float. Roughly 60 percent are held by institutional and retail investors, but key strategic decisions remain concentrated in the hands of a small and experienced leadership circle.

This structure also influences how the company operates. While strategic direction comes from the center, CTS Eventim follows a decentralized model in its daily business. Subsidiaries across more than 20 countries are given autonomy to adapt to local market dynamics, while benefiting from the technological infrastructure and scale of the group. In 2024, the company managed 69 subsidiaries in Ticketing and 133 in Live Entertainment, underlining the breadth and complexity of its operations.

The result is a company that combines strategic continuity with operational flexibility. With long-term leadership, clear ownership, and a platform model that scales across regions and event types, CTS Eventim has built a structure that is well equipped to adapt to change while maintaining control over the key levers of value creation.

What Drives CTS Eventim’s Growth

After outlining the company’s structure and leadership, it is time to look at how CTS Eventim has grown and where future growth is expected to come from. Over the past two decades, the company has transformed from a regional ticketing specialist into a leading international player in the live entertainment and ticketing industry. This transformation was driven by a combination of organic growth, international expansion, and strategic acquisitions.

Historically, growth has come from two main sources. In the Ticketing segment, CTS expanded its footprint primarily through acquisitions. By entering new markets via local providers, the company was able to rapidly scale its platform without the need to build customer bases from scratch. In contrast, the Live Entertainment segment has grown largely through organic means. Rising demand for concerts, festivals and touring productions, as well as the company’s increasing role as a full-service provider, have helped fuel its expansion. Although a precise breakdown between organic and acquisition-based growth is not disclosed, it is likely that acquisitions now account for a significant portion of incremental revenue given the maturity of many core markets.

Recent years underscore this strategy. In 2024, revenue grew by 19 percent to 2.81 billion euros, with adjusted EBITDA increasing by 21.9 percent to 542 million euros. These gains were supported by both underlying business momentum and the integration of several newly acquired entities, including See Tickets in the UK and the USA, Punto Ticket in Chile, Teleticket in Peru and a majority stake in France Billet.

Looking ahead, CTS Eventim continues to pursue a dual strategy. In established markets like Germany and Italy, where the company already holds leading positions, organic growth will likely be modest. Here, improvements will come from digital innovation, better customer segmentation and higher average revenue per ticket. At the same time, the company plans to enter new international markets and deepen its presence in regions such as North and South America. Recent acquisitions play a key role in this process, enabling CTS to deploy its platform model quickly and with minimal infrastructure investment. Additional expansion is also expected in Asia, where CTS has laid initial groundwork through a joint venture launched in 2021.

A central pillar of the company’s growth strategy is its increasing involvement in venue operations. With new arenas under development in Milan and Vienna, CTS aims to strengthen its role across the entire value chain from ticketing and promotion to venue management. Although the live entertainment segment generates lower margins than the core ticketing business, both parts of the company operate with relatively low capital intensity. CTS typically manages venues without owning the real estate, which helps keep fixed costs low. Instead of tying up capital in property, the company earns revenue from ticket sales, catering and merchandising. This model allows the company to maintain growth momentum without placing excessive strain on the balance sheet.

Industry forecasts suggest moderate underlying market growth. According to verifiedmarketresearch.com, the global market for live event ticketing is expected to grow at around 4 percent annually until 2032. Broader trends in live entertainment and international expansion may support even higher growth rates in specific regions. Against this backdrop, CTS Eventim is expected to grow revenue by around 5 to 7 percent annually over the coming years. This projection is based on underlying market growth as well as the company’s ongoing acquisition strategy, which may lead to some fluctuations in year-to-year results. The ticketing segment, in particular, is likely to expand at a faster pace due to its scalable nature and recent acquisitions. Given its significantly higher margins compared to the live entertainment business, earnings growth in the range of 7 to 10 percent appears realistic. Much of this will depend on the continued success of its international expansion, the ability to extract synergies from past acquisitions and the development of its venue portfolio.

Looking ahead, growth will likely remain a mix of selective acquisitions and continued expansion of existing operations. The real question is not whether CTS Eventim will grow, but how effectively it can integrate newly acquired businesses and scale its platform across the markets it already serves. With the right execution, the company has all the tools to steadily continue growing over time.

In my view, the company heavily relies on ongoing acquisitions to maintain its growth rates. I see this as problematic, as it requires not only identifying suitable targets but also agreeing on a reasonable price and successfully integrating the acquired businesses. This approach always comes with risks and challenges, even though it has been executed very successfully in recent years. Moreover, as the company grows, the pool of potential acquisition targets shrinks and regulatory hurdles tend to increase. All in all, I view this type of growth much more critically than organic growth.

CTS Eventim’s Edge in a Competitive Landscape

Understanding the competitive landscape and CTS Eventim’s position within it is essential to evaluate the strength and quality of the business. The global market for ticketing and live entertainment is highly competitive. It is fragmented, with many smaller regional players and just a few dominant international companies. CTS Eventim belongs to the latter group and plays a leading role, especially in Europe.

In Germany, CTS controls around 80 percent of the ticketing market. Similar dominance exists in Austria, Switzerland, Italy and France, where it often holds more than half of all ticket sales. These numbers reflect more than just reach. They signal long-standing relationships with venues, artists and promoters, as well as deep integration across all steps of the value chain. Outside of Europe, the picture is different. Ticketmaster, a subsidiary of Live Nation, is the global leader with strong positions in the US, UK and Canada. CTS Eventim is still a challenger in these markets but has made notable moves, such as the acquisition of See Tickets and new footholds in Latin America through Punto Ticket and Teleticket.

Other global competitors include StubHub, Vivid Seats, SeatGeek and TickPick, most of which focus on the secondary market. Regionally, players like Ticketcorner, Oeticket or Etix remain relevant but lack the scale and integration of CTS Eventim. Despite the fierce competition, CTS holds its ground with a differentiated offering and a strong European presence.

In such a competitive field, it is essential to have a real and lasting advantage. CTS Eventim’s edge is built on multiple layers. One of the most important is its high customer reach combined with exclusive rights. Many of the most sought-after events can only be booked through its platform. This gives the company strong pricing power and the ability to set the rules of engagement for large parts of its customer base. However, when it comes to artists and promoters, the dynamic shifts. These partners often have strong brands of their own and are able to choose among several distribution options. To win their business, CTS must offer attractive terms and reliable execution, especially in new international markets.

Beyond access and pricing, CTS Eventim’s moat rests on its integrated business model. The company does not only sell tickets. It organizes shows, runs its own festivals and even operates major venues like the Arena in Milan. This vertical setup means that it captures value on both ends of the entertainment chain and ensures tighter control of margins and customer experience.

Technology is another pillar. CTS continues to invest in improving its digital platforms and has developed powerful tools for online ticketing, mobile access and data-driven event marketing. These platforms are scalable, reliable and increasingly personalized, offering venues and promoters the tools to optimize attendance and customer retention.

Switching costs play a big role, too. Once a promoter or venue is fully integrated into the Eventim system, moving elsewhere becomes costly and time-consuming. That stickiness, paired with CTS’s financial strength, creates long-term stability. The company can invest in platform improvements, take bold strategic steps and make acquisitions that smaller rivals simply cannot afford.

Experience matters as well. Over the years, CTS Eventim has been involved in organizing some of the world’s largest concerts and sporting events, including World Cups and the Olympic Games. This credibility not only enhances its reputation but also makes it a trusted partner in a high-stakes industry where reliability is everything.

CTS also benefits from its portfolio of strong brands across different regions and market segments. From popular music festivals to major theaters and sports events, the company has built a reputation that is difficult to match. Its network of subsidiaries, exclusive contracts and close artist relationships forms a protective layer around its business. While no moat is permanent, this combination of assets and capabilities offers real resilience.

All of this gives the company a strong moat. While the market will remain competitive and new technologies might bring change, CTS Eventim has the moat to stay ahead. It is not immune to pressure, but it plays from a position of strength.

Where the Profits Come From

Let’s take a closer look at the profitability of CTS Eventim. While the company appears highly efficient at first glance, a more detailed view reveals a business model with two very different sides. Understanding how they interact is crucial to evaluating the quality and financial stability of CTS.

At the core of CTS Eventim’s earnings power lies the ticketing segment. This is a digital platform business with strong network effects, low variable costs and limited capital requirements. As a result, the segment regularly delivers EBIT margins of 40 to 50 percent. Its efficiency is further supported by high switching costs for clients, favorable pricing power and limited operational complexity. Over time, these characteristics have turned ticketing into a stable and reliable cash engine for the group.

The second segment, live entertainment, follows a completely different logic. Eventim often acts as the promoter or co-organizer of events and thus takes on substantial responsibility. That includes advance payments to artists, logistics, location rentals, technical equipment, security and marketing. These activities generate large revenue volumes, but they also come with significant direct costs and lower margins. Even in a strong year, EBIT margins rarely exceed 5 percent. In the first quarter of 2025, the segment delivered an EBIT margin of just 0.3 percent and an adjusted EBITDA margin of 4 percent. These figures illustrate how narrow the profit window is, particularly in periods of low activity or increased cost pressure.

To fully understand this margin structure, it’s important to look at the broader strategic context. CTS Eventim does not pursue live entertainment purely for its profitability. Instead, the segment supports the growth and stability of the higher-margin ticketing business. By organizing its own events, the company gains access to exclusive content, controls distribution and strengthens its market position. Events run through the group’s own ticketing infrastructure, which boosts platform usage and creates synergies between the two units. The live segment also plays a key role in entering new markets, as organizing major shows often precedes long-term ticketing contracts. In this light, the lower margins are an accepted trade-off for strategic control and long-term value creation.

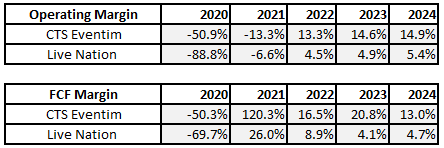

A quick look at CTS Eventim’s operating margin and free cash flow margin compared to market leader Live Nation reveals that CTS operates with significantly higher profitability. This is partly due to the higher share of the more profitable ticketing segment in its business mix.

Note: Due to the COVID-19 pandemic and the widespread cancellation of public events, the margins in 2020 and 2021 are heavily distorted and should be interpreted with caution.

Let’s have a quick look at the capital intensity of CTS Eventim’s business model. CTS follows a capital-light approach. The company does not own or directly develop venues but typically operates them in partnership models. As a result, there is virtually no capital expenditure tied to real estate or construction. Instead, most investments are directed toward the company’s digital infrastructure. Regular spending on software, platform maintenance and system upgrades is essential to keep the business efficient, secure and scalable but overall, the reinvestment needs remain manageable and predictable.

One area of concern for investors is the volatility of free cash flow. While the platform business generates steady cash, the live segment is subject to seasonality, project-based timing and prepayments that can distort quarterly results. Cash outflows for artist deposits or major projects often occur months before revenue is recognized. This mismatch, combined with swings in demand, explains why reported free cash flow tends to fluctuate more than net income.

In the end, the profitability profile of CTS Eventim reflects a deliberate balance. One side of the business delivers recurring, scalable profits. The other side provides strategic flexibility, content access and market penetration, even if it reduces short-term margins. On a group level, this model results in a healthy blended margin profile, with a long-term net margin around 10 percent. As long as the company manages this balance well and continues to scale its platform, the margin structure should remain intact despite the inherent fluctuations.

I view the Live Entertainment segment and its profitability as particularly concerning. While the synergies with the ticketing segment are clearly visible, I find the very low margins especially problematic during challenging market phases, as they could lead to losses during those periods. In addition, the segment generates highly volatile cash flows and lacks scalability, which further limits its attractiveness

Financial Strength as a Strategic Asset

In a cyclical industry like live entertainment, a solid capital structure is essential.

CTS reports an equity ratio of 29.1 percent. That may not seem particularly high at first glance, but it reflects a solid and stable foundation, especially when compared to other players in the industry. Many competitors operate with far more aggressive balance sheets and rely heavily on debt to finance their operations. In contrast, CTS Eventim maintains a more conservative capital structure, which provides the flexibility to pursue acquisitions and strategic initiatives without putting the business at risk. In times of crisis or market downturns, this level of financial discipline can make a crucial difference.

To better understand CTS’ capital structure, we should take a closer look at its balance sheet. One important distinction is between actual financial debt and operational liabilities. A large part of the short-term liabilities comes from advance payments for tickets to events that haven’t happened yet. These are not traditional debts but temporary items. If we focus only on the real financial liabilities, CTS Eventim reports just over 123 million euros. Since the company holds more cash than financial debt, it currently has no net debt. This underlines its financial strength and flexibility to fund future growth without depending on outside capital.

That said, investors should keep an eye on goodwill, which has risen notably in recent years due to the company’s acquisition strategy. As of 2024, goodwill accounts for around 60 percent of equity and approximately 12 percent of total assets. While this is not unusual in a business built on strategic takeovers, it does represent a potential risk in downturn scenarios, where impairments could weigh on future results.

Despite these factors, CTS Eventim’s financial setup remains healthy. The company pays a regular dividend that is easily covered by free cash flow. Moreover, it has enough internal resources to fund both acquisitions and shareholder distributions without straining its balance sheet. This balance between prudence and ambition is one of the reasons why Eventim has outperformed many of its peers over the past two decades.

What Is CTS Eventim Really Worth?

As Buffett uses to say: „Price is what you pay, value is what you get.“ So in this final step, let’s take a closer look at CTS Eventim’s current valuation.

To assess the intrinsic value of the company, I used a standard DCF model. The assumptions are based on the qualitative and quantitative insights discussed in previous sections. I estimate annual revenue growth between 5 and 7 percent, with earnings growing slightly faster at 7 to 10 percent. These assumptions reflect the company’s continued international expansion, pricing power in its core markets, and operational leverage within the ticketing segment.

For the discount rate, I used Damodaran’s current data for the entertainment industry: a cost of equity of 9.1 percent, cost of debt of 5.8 percent, and a weighted average cost of capital (WACC) of 6.7 percent. I assume a long-term perpetuity growth rate of 2 percent, which seems reasonable for a business with a stable competitive position in a maturing industry. Margins are assumed to remain stable or improve only slightly over time.

Based on these assumptions, the fair value of CTS Eventim stands at around 81 euros per share. With the stock currently trading at 102 euros, the company appears to be overvalued by approximately 26 percent.

Final Thoughts

CTS Eventim has grown from a local player into one of the global leaders in live entertainment. The company has built a strong market position, delivered solid growth in recent years and benefits from attractive margins in its core ticketing business. It also stands out with a strong balance sheet and a management team known for its long-term focus and strategic foresight.

At first glance, it looks like an amazing business. But as the analysis progressed, my view became more nuanced. Growth relies heavily on acquisitions, which come with risks and challenges. The live entertainment segment adds volatility, has low margins and is difficult to scale. Artists and agencies hold significant bargaining power, and the competitive landscape remains intense.

While the company is fundamentally solid and clearly well managed, I would not consider it a must-have for a portfolio built around the highest-quality compounders.

I hope you enjoyed the deep dive. If you're into discovering quality compounders and under-the-radar opportunities, feel free to subscribe for more.

Thanks a lot for this article; it's very insightful. You had a good sense not to invest at approximately 100€/share, though Schulenberg bought more shares at this price in September. So, I guess he sees that more value can and will be unlocked. I'll monitor Eventim and might jump in if it goes down more.