Games Workshop has been one of my largest positions for some time now. I recently published a full deep dive on the company, which you can find here along with my full portfolio. Today’s update will build on that work and focus on the company’s latest results and strategic developments rather than starting from scratch.

The company has just closed its fiscal year, which runs on a different schedule from the calendar year. It was another year of impressive growth, with results that reinforce my original investment thesis. Let’s take a closer look at the numbers and what they mean for the future.

Let’s dive in!

Growth, Profitability, and the Road Ahead

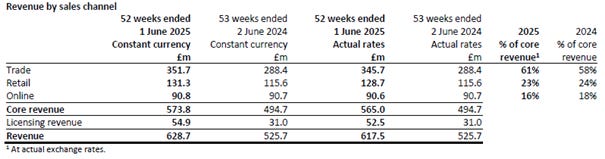

Games Workshop closed its fiscal year with another impressive performance. Revenue grew by 17.6 percent, driven among other factors by the success of the video game Space Marine 2. This title had a particularly strong impact on the licensing segment, which saw significant gains, and also contributed to higher sales in the core business. The trade channel, which includes sales through external partners, grew by nearly 20 percent. Retail expansion also played a role, with around 30 new stores opened during the year, resulting in an 11 percent increase in that segment. Online sales grew by approximately 15 percent, showing that demand remains healthy across both physical and digital channels.

The distribution network also expanded significantly. The number of external partners rose from 7,200 to 8,100 in a single year, and Games Workshop now sells in 71 countries. Importantly, the company achieved organic growth in every single market. China was a notable highlight with growth of more than 20 percent, although management sees this as only the beginning. Investments in building the local team are already underway to accelerate the company’s presence in the region. It becomes clear that organic growth across all channels remains firmly intact.

Licensing was another standout contributor this year, with fees increasing by 69 percent to 52.5 million pounds. Management has made it clear that this was largely a one-off effect, primarily driven by Space Marine 2. However, this surge had a meaningful impact on both overall growth and profitability, as licensing carries significantly higher margins than the company’s other segments.

The strong performance has been accompanied by substantial investments aimed at supporting future expansion. Construction of “Factory 4” in Nottingham is underway and scheduled for completion in summer 2026, with around eight million pounds in costs expected this year. In addition, the company has purchased and converted a nearby building into a new paint factory, further enhancing its production capabilities. It has also acquired an additional piece of land close to headquarters that is currently used as a parking area but could later be developed to increase capacity.

At this point, it is worth noting that Games Workshop keeps the entire manufacturing process in-house. This results in higher capital expenditure, but it ensures full control over quality and production timelines. Figures produced in Nottingham are shipped to regional logistics hubs before reaching stores, maintaining both availability and efficiency. These investments demonstrate the foresight of management, which is actively laying the groundwork for long-term growth rather than simply chasing short-term gains.

The strong top-line performance translated into even faster bottom-line growth. Earnings per share rose by 29.6 percent, well ahead of revenue growth, reflecting the combined effect of higher-margin licensing income and a modest improvement in the profitability of the core business.

In this context, management noted that new tariffs could reduce net profit by around twelve million pounds in 2026, equivalent to roughly six percent of annual earnings, and lower gross margin by about two percent. However, these impacts are not expected to alter the company’s strategic direction. Games Workshop will continue to expand its US distribution network, reinforcing its presence in what remains one of its most important markets.

One of the most striking figures in the report was the return on capital employed, which climbed from an already exceptional 176 percent to 191 percent. This underscores the company’s ability to generate outstanding returns while maintaining a disciplined, long-term focus. Furthermore, the high margins show that the company still has an exceptionally strong durable moat.

The management has been clear that the current strategy will not change, with an unwavering commitment to the company’s long-term growth plan. Alongside steady organic expansion, licensing will remain an important growth driver, supported by further video games and media projects. This includes the ongoing collaboration with Amazon to produce both a series and a movie, a partnership that management views positively, even if no short-term financial results are expected. Also customer satisfaction and engagement remain at the core of this strategy, as evidenced by the rising subscriber numbers for Warhammer+, the company’s streaming platform.

Looking at regional expansion, future growth is expected to come increasingly from entering new markets. Alongside the established regions of Europe and North America, the company is aiming to strengthen its presence in Asia and eventually move into South America. This geographic diversification should allow Games Workshop to maintain solid organic growth rates over the coming years while also unlocking significant long-term potential.

Overall, the latest results confirm that the business is performing strongly, executing on its strategy, and positioning itself for long-term compounding.

Latest Results Confirm My Price Target

After reviewing the latest results, it is worth revisiting my valuation framework to see whether any adjustments are needed. When comparing the current figures with the assumptions I used in my previous analysis, the differences are minimal. I continue to work on the basis of a free cash flow margin of 30 percent for the coming years, which is slightly below the five-year average of 32 percent. In addition, my model incorporates Damodaran’s estimates for the weighted average cost of capital at 8 percent, a risk-free rate of 3.88 percent, a beta of 0.9, and an equity risk premium of 4.6 percent. Based on these inputs, and applying a margin of safety of 30 percent, my target entry price remains unchanged at 117 pounds.

A Quality Company Delivering as Planned

Games Workshop remains a high-quality business that is executing exactly as planned. It continues to deliver solid organic growth, maintain very high and rising margins, and benefit from a loyal customer base. The company’s long-term moat, disciplined and forward-looking management, and strong balance sheet all reinforce my original assessment. The latest annual report has only strengthened my conviction. I will hold my current position and will consider adding more shares if the valuation becomes more attractive.

I will continue to keep you updated on Games Workshop and all the other companies in my portfolio, so stay tuned for future coverage.

Interesting company, will take a separate deeper look. I am interested to hear your opinion on one thing though, do you see any short-term catalysts causing further price appreciation? The stock seems to be trading roughly flat YTD.

Thanks for this write-up! I remember this company had been a favorite of a lot of value investors in the past. Goodread